Picture charge: iStockphoto

Their counterparts are catching media firms because proof of China’s high growth emerges in the latest Digital Media Index from research firm Strategy Analytics.

There is a feeling of inevitability about China’s emergence as an electronic media superpower, even though there is not likely to be a seismic shift in media spend from west to east anytime soon.

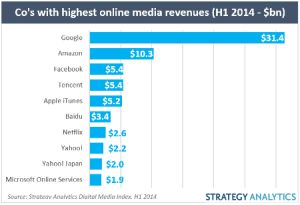

With Baidu and Tencent, Strategy Analytics reports that China boasts two of the six firms with the world media revenues and four of those ten fastest-growing. Yahoo Japan also signifies Asia in the top ten.

Chinese online service portal Tencent drummed up digital press revenues of $5.4 billion in the first half of 2014, an increase of 43% year-on-year, and web services firm Baidu grew up 56 percent to $3.4 billion.

Slower increase in US

US firms Google and Amazon are outside in the lead by some margin, but their growth is considerably less with digital revenues rising year-on-year by 12% and 9% respectively. The stats imply a changing of the guard is years rather than decades away.

US firms Google and Amazon are outside in the lead by some margin, but their growth is considerably less with digital revenues rising year-on-year by 12% and 9% respectively. The stats imply a changing of the guard is years rather than decades away.

A sterner test awaits firms when by duplicating success in other countries they seem to keep their levels of growth, according to Michael Goodman, Director, Digital Media for Strategy Analytics.

“The fact that there are about 2.5x more Chinese than Americans online is a large factor so they’ve been able to hit such heights solely in a national sector. The big question, and also the crucial threat to US global dominance, is if they could translate this success outside China.”

Fall in Yahoo revenue

Yahoo was the only digital media firm in Strategy Analytics’ top ten that saw digital media revenues decline 3at the first half of 2014, a period when the company sought to sell its stocks in business Alibaba.

Whereas 100% of Baidu’s revenue is sourced from advertisements, the business model of Tencent is different. It makes 90% of earnings from games is uncommon among Chinese businesses.

“The Chinese companies have been particularly adept at generating earnings across a variety of services. The fastest mover, Qihoo, for example has done well in both Internet and advertising value-added solutions, driven by expansion into mobile and search,” he revealed.

“Finally, this raises revenue per customer, a very important part of sustained expansion — Baidu, for example, has upped ARPU 50% during the last year.”